How Energy Business Intelligence Informs Investment

Download HEAVY.AI Free, a full-featured version available for use at no cost.

GET FREE LICENSEWhat does Business Intelligence have to do with the energy and utilities sector? Plenty, if you’re looking for a more strategic approach to energy investments.

The need for energy is growing exponentially around the world – as are the variety of available energy assets and our opportunities to invest in sustainable options. Energy efficiency, a top priority for energy companies and investors, is determined by a wide variety of factors. These factors generate an enormous volume and variety of raw data that, with the right tools, can be transformed into invaluable, actionable data intelligence that will help inform investments.

Business Intelligence tools offer a wealth of insight that can inform investments in a wide variety of energy-related areas, such as acquisitions, productivity drivers, suitable land, and determining which type of renewable energy investments to pursue. Read on to learn more about the specific ways that energy business intelligence can help us discover better, data-driven energy investment opportunities.

Acquisitions

There has been a noticeable surge in energy mergers and acquisitions around the globe. Businesses are looking to expand by acquiring smaller companies and entering new markets in order to enhance their competitiveness. There are also energy companies that are ready to be purchased. And with so many markets at play - metals and mining, chemicals, agribusiness, climate and sustainability, oil, and more - it is crucial for companies interested in market expansion to adopt an energy business intelligence tool that can make sense of all that data and identify the best energy companies to invest in.

Energy BI tools provide advanced business analytics around the full energy-value chain, and enable acquisition and divestment professionals to aggregate, view, and analyze energy data from a wide variety of different companies and markets. This data can then be used to economically evaluate asset acquisition metrics in these companies and markets.

Energy BI tools and energy analytics accelerate time to insights with intuitive business intelligence dashboards that make it easy to quickly get answers to specific questions related to market expansion, such as benchmark performance, productivity drivers, market trends, and more. Energy business intelligence provides a technological leap forward and clear competitive advantage.

Productivity Drivers

What’s doing well? What’s not doing well? Why? Understanding why an energy asset is performing a certain way is an important factor in deciding what to invest in.

For instance, if an oil well is underperforming, is the supply running low? Or is a piece of equipment malfunctioning? Are there inefficiencies in the daily workflow? Perhaps outdated technology is still in place and it’s time to invest in new technology. It could be any combination of factors.

Data analytics in energy and BI tools help collect and visualize data in a digestible way that makes it easy to identify patterns related to productivity. Understanding what’s working and what’s not helps decision makers decide where to invest and where to divest.

A consolidated view of all company data can illuminate if you should invest more in physical capital, like equipment and workspace; new talent, which will bring in new skills, ideas, and innovation; new enterprise opportunities, like small business acquisition; and/or more time spent analyzing the behaviors and activities of the competition.

Land Suitability

You wouldn’t invest in a dam in an area that is predicted to experience drought, or in windmills in an area that’s not particularly windy. Determining a plot of land’s suitability for various energy assets would be pretty daunting if you had to visit each area in person. Luckily, you don’t have to. Thanks to remote sensors and advanced BI tools, we can assess the physical attributes of a piece of land from nearly anywhere.

Remote sensing data for land suitability assessment is vast, varied, and ever changing. Just some of that data includes:

- Geothermal: thermal infrared is used to gather surface temperature data

- Hydroelectric: GIS collect geological and structural mapping data; remote sensors collect basin water drainage pattern data

- Biomass: biomass is measured using data from Radar, LiDAR, optical remote sensing, spatial data processing, and image fusion

- Wind: remote sensors collect atmospheric turbulence, wind speed and direction, temperature, moisture, and water vapor data

- Solar: remote sensing data from geostationary satellites is used to help derive surface solar irradiance from satellite images

- Natural Gas: uses current and historical data regarding over the counter swap information, volatility, interest and exchange rates, assessed prices and future prices, technical analysis, and geopolitics; remote sensors collect data related to power generation and distribution, production, logistics, geospatial and time-series.

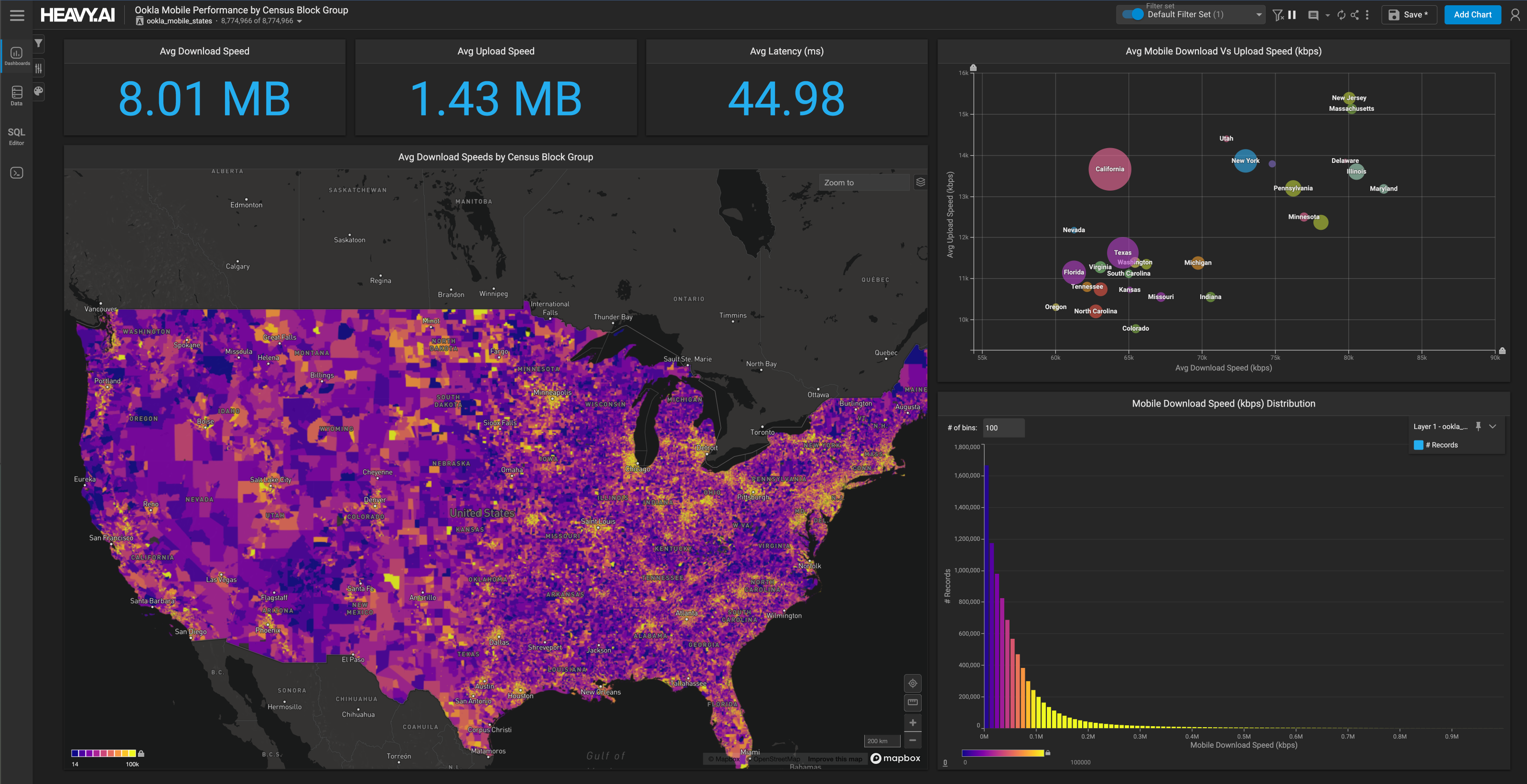

That’s a lot of data to make sense of, and it’s not going to make a whole lot of sense on a spreadsheet. Thankfully, advanced business intelligence solutions can quickly and easily ingest and transform massive energy datasets into engaging, interactive data visualizations that give users a unified view of their data and reveal previously hidden insights. Intuitive, point-and-click dashboards are customizable and give users the power to set different parameters and ask specific questions about each area of land.

Renewable Energy Options

Sun, wind, or water? Our choices are growing with our determination to “go green.” But where to invest in green energy? Once you’ve made an acquisition, how do you keep that energy asset productive and profitable? It depends on a wide variety of factors that are constantly evolving. BI solutions help us to gain insight into four major areas of business that can help determine which renewable energy companies to invest in:

- risk intelligence: BI tools can use predictive models to determine risks associated with trading certain energy assets.

- demand intelligence: BI tools help monitor energy costs, service availability, downtime, and energy & utility demand and distribution. This current and historical data is used to identify trends and predict energy usage.

- asset intelligence: BI tools help track asset usage and efficiency, monitor equipment in real-time for preventive maintenance and replacement, and analyze energy generation and outages.

- customer service intelligence: Customers won’t hesitate to tell you where your business is lacking, which provides decision makers with invaluable feedback, but only if they can get through to you. Intuitive BI dashboards will help streamline call center operations and increase efficiencies.

The data involved in choosing the best alternative energy investments to pursue, and understanding where to invest your money and time to keep your energy assets profitable, is vast and varied. BI tools provide data visualizations that are digestible and significant so that users can easily understand the energy needs of a particular area, the needs of the customers, the inefficiencies of existing infrastructure, and the potential risks and rewards associated with different energy markets.

The Bottom Line

Data is not just for data scientists, analysts, and engineers. Data is for everyone, and business leaders and investors in the energy sector will be expected to understand how to leverage business intelligence tools to make better, data-driven decisions and investments. Advanced business intelligence tools are designed so that the average user can point-and-click and see how all of their data is connected. This is crucial in the rapidly growing energy markets.

More than ever, it is vital that decision makers in the energy sector adopt a BI and visual analytics platform that helps with transparency, data governance, master data management, and information quality, so that they can obtain actionable business intelligence that aligns with the company’s mission. Challenges such as price volatility, changing regulations, emerging technologies, and even public opinion, all affect how we approach energy investments. BI tools easily turn energy data into intelligence that informs investments and improves decision making for a brighter, greener future for energy. Read more about the future of business intelligence here.