Who’s got the ‘best’ mobile network in the US?

Download HEAVY.AI Free, a full-featured version available for use at no cost.

GET FREE LICENSEBased on the deluge of commercials and ads in this competitive industry, it seems every major player claims that they do. The competition is apparently so fierce that even their spokesmen are being headhunted. Admittedly, it can be a bit confusing when you find these results in one city:

And these in another:

By the way, how do you even define ‘best’ network? It’s a loaded question for sure. We’ll get back to that in a minute.

Who cares?

It’s a question with relevance to nearly every American, considering the vast majority of us own a cellphone of some kind (over 95% according to Pew). And we don’t leave them alone; we touch them thousands of times each day. In fact, a good mobile network can affect our very quality of life. Ever travelled any significant distance with children and poor mobile data speeds?

The same question is also relevant to those very telecommunications providers themselves, of course, and particularly in light of the fact that obtaining new subscribers will increasingly mean winning them away from competitors. Ensuring you are outpacing your rivals with superior network metrics is a key ingredient to both marketing and market share success.

Hey, where did that data come from?

Our friends and partners at Tutela have created the world’s largest mobile information platform, collecting billions of crowdsourced data points anonymously. These span device, network, and application information to allow us to get from data to insights. They’ve graciously given us (and now you) a slice of their treasure trove. Our demo contains a few months of US data (~112M rows), although Tutela has data for more metrics, for nearly every country, and for a much greater timeframe.

So, how do you define ‘best’ network?

There are obviously many variables to consider when it comes to a great network, and one carrier will almost certainly not take the top spot in each category. But we can identify areas of significance where we hope to find favorable results:

- Coverage area

- 3G vs 4G coverage

- Signal strength

- Latency

- Upload and download speeds

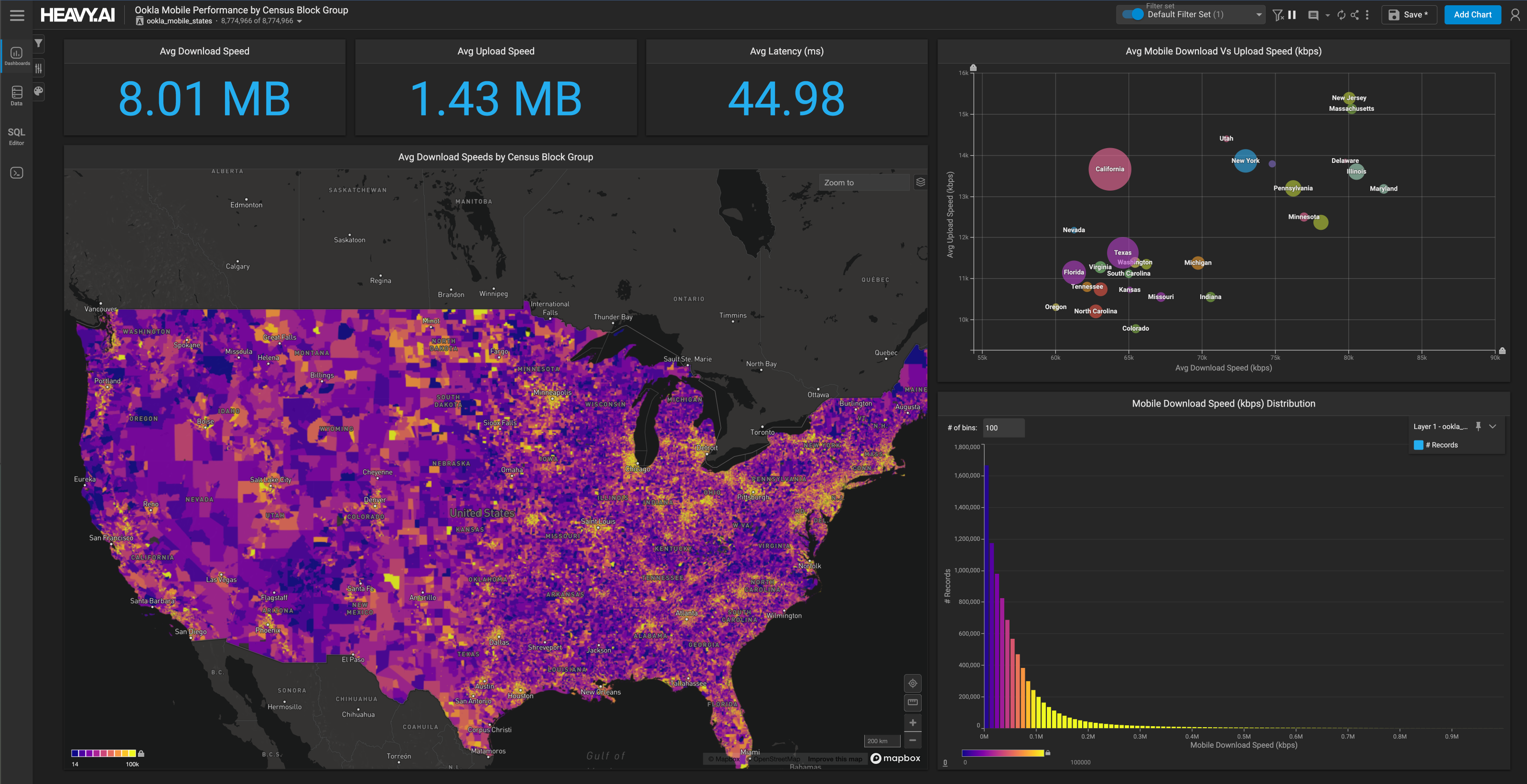

Spoiler alert: we’re not actually going to attempt to find a winner. Those are just some of the metrics you can see at a glance on our MapD Immerse demo dashboard:

This is immediately useful. Coverage, speed, signal strength, and latency all matter, so MapD allows you to visualize and correlate them for effective consumption.

But wait, there’s more!

Not coincidentally, the MapD Immerse visualization tool is purpose-built to leverage the MapD Corebackend GPU-powered, in-memory, columnar SQL database at scale. This allows interactive analysis over multi-billion row data sets, with the ability to drill down to an individual row...in milliseconds. It’s also why Tutela has selected to partner with MapD; no need for indexing, sampling, or pre-computation. This means you can zoom in and out, filter, and more in an ad hoc fashion. Let’s take it for a spin.

Comparing mobile network characteristics by locale.

As a consumer, you might be interested in how well each service provider performs in a certain geographic region (i.e., where you live and work) to aid in making a purchasing decision.

For example, to zoom from country level to the Washington, DC area, just type the city name into the searchbox of the pointmap. MapD Immerse will automatically zoom in when you click enter. It looks like in this region, you might lean toward Verizon:

But it may not be as clear cut if you live in San Francisco:

.gif)

In either case, Sprint better have some compelling discounts or incentives to entice new subscribers. Further, both Sprint and T-Mobile might leverage this information to prioritize buildout or upgrade of cell towers. If they’re analyzing subscriber loss in these areas, this also may give them insight into why that could be occurring.

Spot trends.

Another valuable feature of the MapD platform is the ability to easily identify trends, anomalies, or outliers. Visualization can often be an invaluable enabler for these situations. Sometimes new revenue opportunities or cost savings can be had by capitalizing on correlations in data that you didn’t even realize existed!

See the spike in data downloads in the line chart? By highlighting the time frame with your mouse, MapD will cross filter all charts using the selected time slice. Doing the same with the line chart for data uploads further reveals that the largest spikes occur on May 28 and 30. Ah, that’s Memorial Day weekend in the United States. So this makes sense.

We can get even more granular and note that the bulk of data transfer occurred between 12-1am local time (4-5am UTC) as the heatmap indicates. I wonder if Uber and Lyft also experienced a spike around that time, as celebrations came to an end?

.gif)

Your turn.

When data exploration at scale is so easy, what other interesting insights will you find?

Explore this demo using Tutela's dataset on MapD’s platform on your own here.

If you’d like to learn more about MapD’s recently announced partnership with Tutela, watch our on-demand webinar, introducing and demonstrating Tutela Explorer, a new mobile data analytics solution that provides real-time, interactive and highly visual insight into the performance of mobile networks and device usage. Tutela Explorer is available now as-a-service with global data coverage from Tutela.